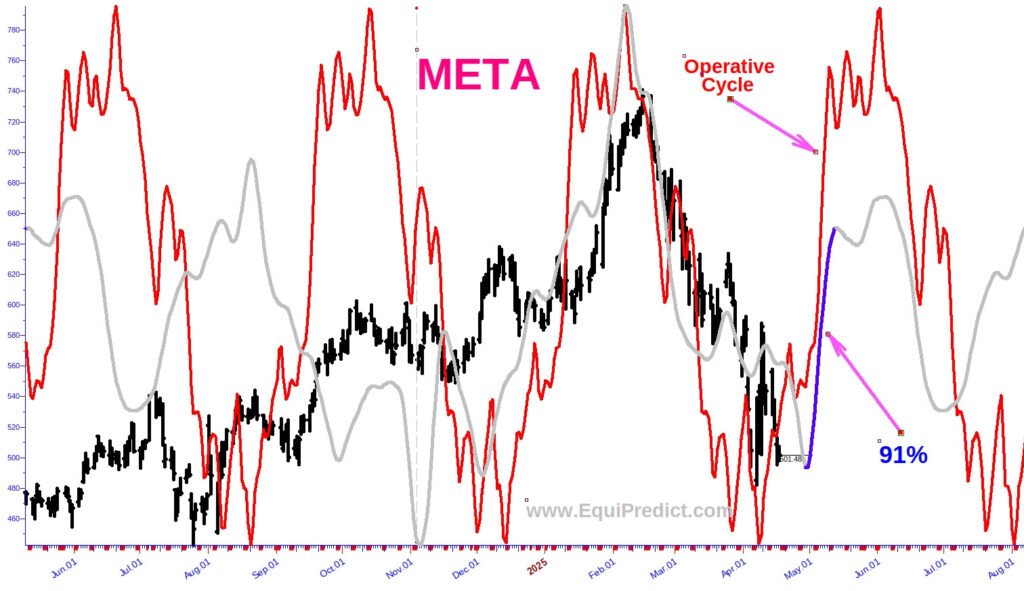

Edit 5/17/25: The result of the Blue Wave forecast is now posted below the original forecast.

Before getting to the Meta Platforms (Facebook, Ticker: META) forecast, a quick note on today’s price action:

Today marked another “down day” in the markets, but market makers are gladly picking up shares of those panic selling. For those newer to actively participating in the markets, market makers are the ones who actually MAKE the market. They are the individuals and institutions who set opening prices for the day. They are allowed (legally) by the SEC to buy and sell shares from their own inventories. Liquidity in the markets would not be possible without them. Regardless how you feel about market makers, it’s crucial to watch their behavior.

Today, and since the April 7th 2025 low, market makers have been actively buying up shares. Here is how to tell:

(charts expand upon click)

The opening of the day gapped down across all indices, causing panic selling throughout the day. Market makers stepped in around 2pm and began to buy up shares through the close, erasing over 1% of losses, intraday. The rally in the above chart is not retail traders buying.

EquiPredict is not a technical analysis platform, but occasionally it’s appropriate to bring some perspective to price action behavior and the story it tells.

Now onto the Meta Platforms (Ticker: META) forecast.

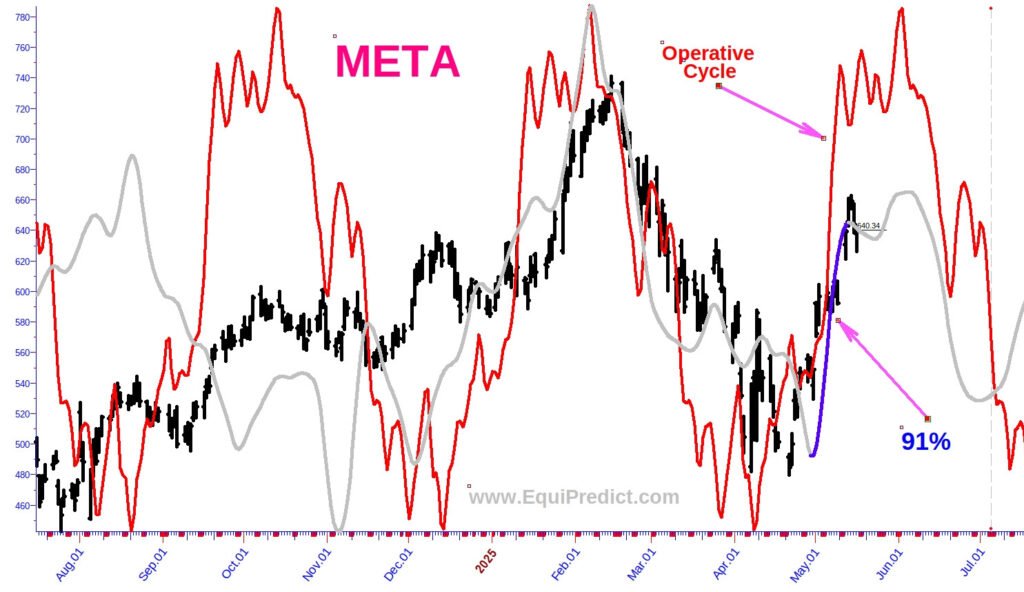

An operative cycle exists in META and has been effective since 2023. These cycles can always “invert” at any time, but this is likely to be one to watch for the months ahead. It is not perfect, but again provides a guideline to follow.

Adding to the evidence displayed by the EquiPredict cycle model (red), a 91% natural cycle (blue) has been uncovered beginning with 5/1 and remaining in-place until mid-May.

According to the forecast, this is not the time to be disposing of META shares.

5/17/25: Blue Wave Forecast results: