This forecast compares two very different stocks: Target Corporation (NYSE: TGT), a cyclical retail stock, and Southern Company (NYSE: SO), a defensive utility provider. By contrasting cyclical and defensive market behavior, investors can better understand sector rotation and upcoming opportunities.

Each chart expands upon click.

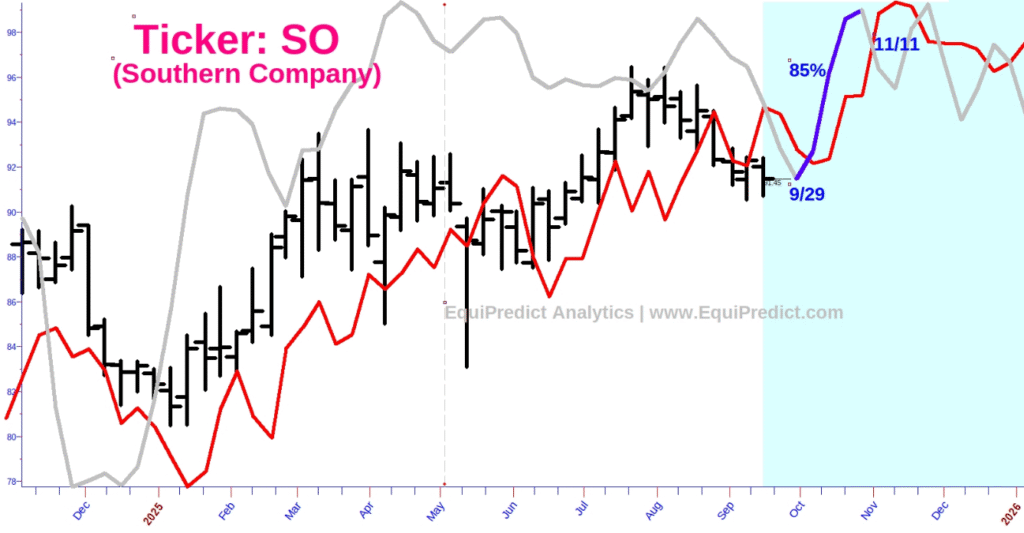

Southern Company (SO) Forecast

Southern Company has held up fairly well in the broader marketplace with a pullback currently taking place. According to our forecast, a bullish bias is likely to resume near the end of the month. Investors should not expect a sharp rally but rather a gradual, steady climb into November. This makes SO more suitable for conservative positioning.

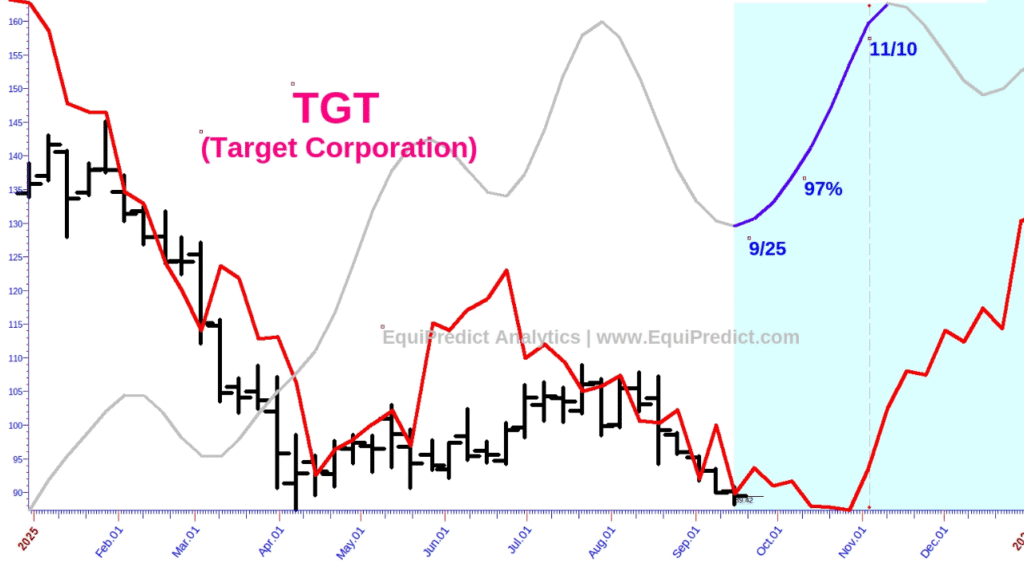

Target Corporation (TGT) Forecast

Target has been under heavy selling pressure since July 2021, pushing the stock into oversold territory. We posted on May 22nd a forecast for a summer rally in Target. Our analysis suggests a potential test of the $78 level before another rebound. From there, a bullish rally into November is expected. The Blue Wave forecast model shows a 97% probability of bullish bias between the highlighted dates.

👉 Don’t miss the next move. Subscribe to EquiPredict Analytics for full access to all previous and upcoming forecasts. Join now. Cancel anytime.