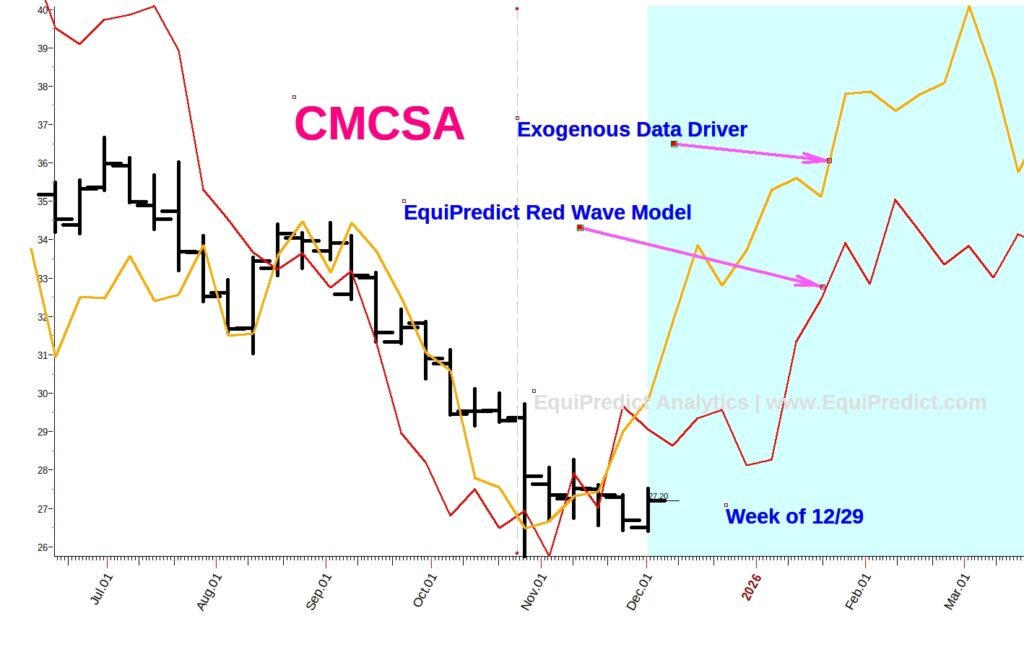

Comcast Corporation (CMCSA) is entering a period where our cyclical and data-driven models point to a strengthening bullish bias through the end of December and into the first quarter of 2026.

Two independent forecasting systems – our Exogenous Data Driver Model and our EquiPredict Red Wave Model – are now aligning, suggesting that CMCSA may be preparing for a meaningful upward phase. When these two models synchronize, the probability of directional follow-through historically increases.

Key Outlook

- Bullish momentum is expected to begin taking hold during the final week of December.

- This upward bias is projected to continue through late February and into March, barring major macro shocks.

- CMCSA is currently trading near $27/share, and both models point toward a constructive environment that favors higher prices into Q1.

Model Insight

- The Exogenous Data Driver Model tracks non-price external variables known to influence equity performance. Its December–March window suggests expanding positive pressure on CMCSA.

- The EquiPredict Red Wave Model, which maps cyclical turning points and directional bias, also turns upward in late December and maintains a rising trajectory into March.

When these two systems agree, the forward path historically becomes clearer – and right now, both suggest accumulating bullish force over the next several months.

Conclusion

While CMCSA has been range-bound in recent months, our models indicate that this consolidation phase may give way to a more constructive trend as we approach year-end. If the projected bullish window plays out, CMCSA could see meaningful appreciation from current levels heading into March 2026.

Get the Free Monthly Sentiment Outlook

Stay ahead of market tone with our free monthly sentiment forecast for the Dow Jones, S&P 500, and Nasdaq. Delivered by email before each new month begins.

Get This Month’s Sentiment Forecast FreeNo credit card required • Unsubscribe anytime