Over the past year, many of you have been using EquiPredict forecasts to understand where probability is tilted ahead, particularly for QQQ and major indices.

One common question I receive is:

“How should I think about overall market risk when applying these forecasts?”

To help answer that, beginning in early February the dashboard will introduce a new feature:

‘Current Weekly Risk Regime‘

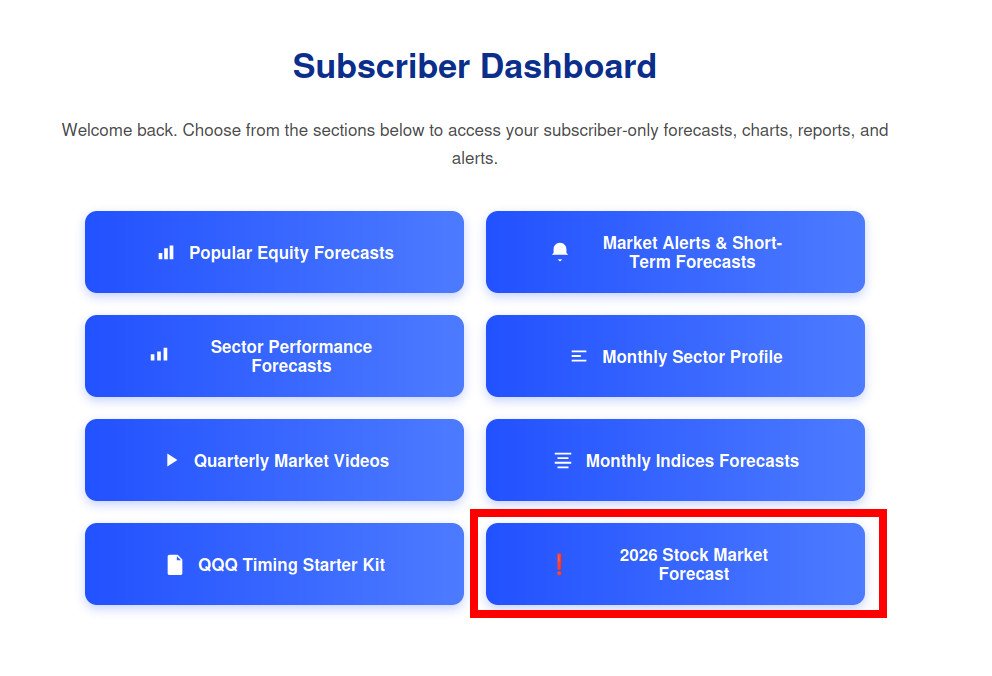

This will replace the current “2026 Forecast” button on the subscriber dashboard (see below).

The Weekly Risk Regime is a simple, objective view of whether the broader Nasdaq market environment is currently:

- Risk-On = (favorable for deploying risk)

- Transition = (mixed / higher uncertainty)

- Risk-Off = (defensive conditions)

This does not replace forecasts. The risk regime posts complement them.

Friday’s weekly closing data for the Nasdaq (QQQ) is needed. Thus, the risk regime information will likely be posted between Sunday morning and Monday market opening.

Think of it as a simple risk context layer that helps you:

- Size positions more intelligently

- Understand when conditions favor pressing risk vs staying conservative

- Add discipline around volatility and draw-down management

Your existing probability-based forecasts remain unchanged.

More details will be posted once the feature goes live.

– Matt, EquiPredict Analytics