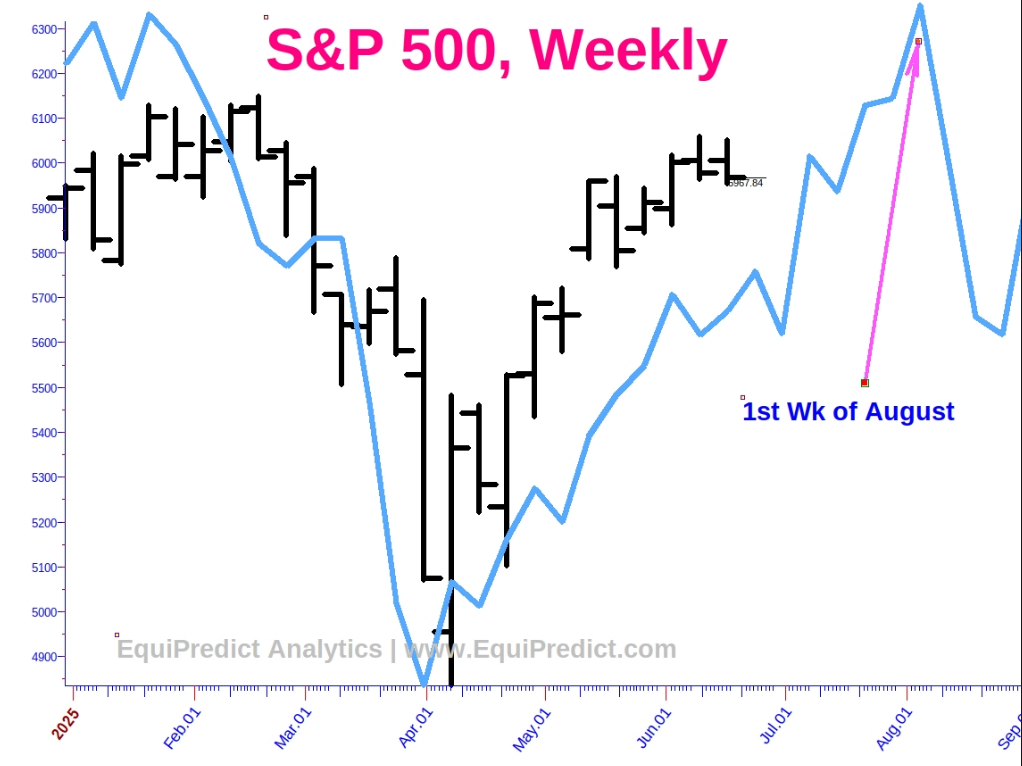

The market has shown strength into what was forecasted to be a short term cycle low at this time. The fact the market did not sell-off into this low is bullish in the intermediate term.

As long as a “cycle inversion” did not occur (meaning the markets move in a completely opposite direction than a given forecast) the markets often find greater bullish lift after moving into a cycle low without price action collapsing into it.

My work and the work of my partners here at EquiPredict Analytics involves continually approaching the market from various and unrelated angles in an attempt to produce forecast data that conflicts. This might sound like a counter-intuitive approach, but the reason behind identifying disagreeing data is simple:

Risk Management

If you manage risk, the market takes care of the rest. The market is designed to go up in the long run, not down. Thus, if we can produce forecasts that DISAGREE, we know we likely do not have a stable forecast.

If forecasts from various approaches do in fact agree, the forecast probabilities rise significantly.

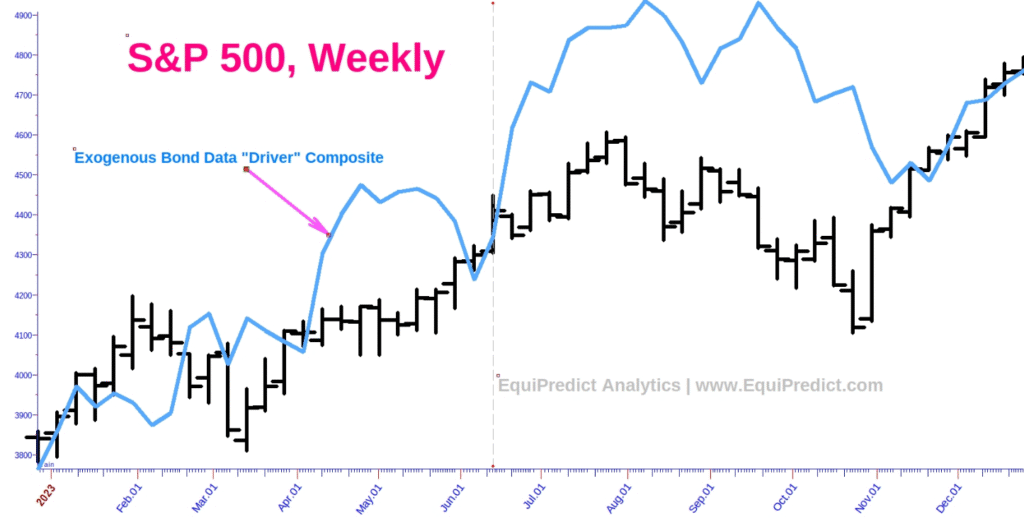

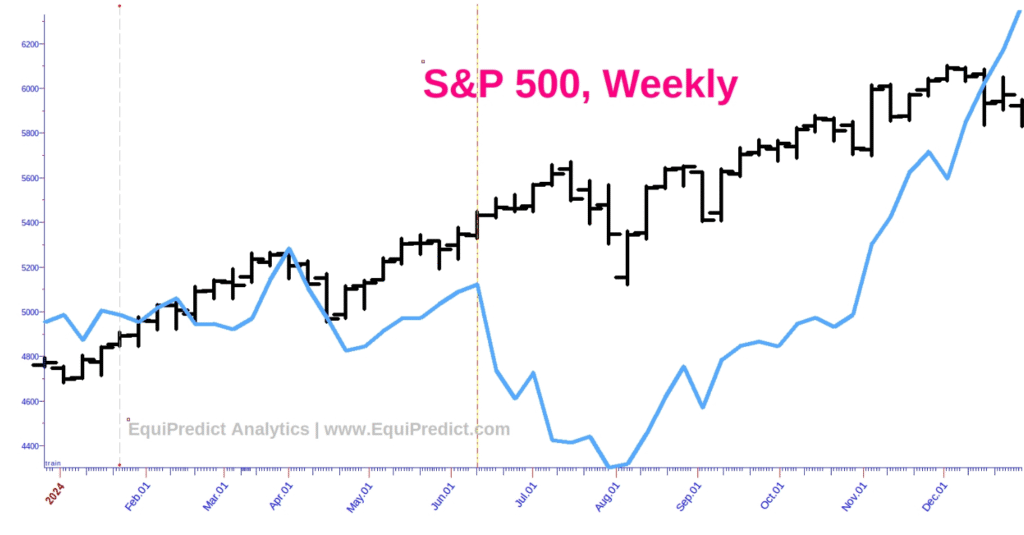

Included here is a composite of varied bond data sets, pushed forward in time. According to the forecast, at the risk of sounding like a broken record, there is no reason to be in a bearish frame of mind until early to mid-August. Markets will likely continue to find lift until then.

[Forecast charts viewable to subscribers only]