Earlier posts and market alerts published here at EquiPredict in 2024 pointed out a rotation taking place from growth toward value areas of the marketplace.

Value areas of the marketplace (i.e.- consumer staples, and stocks like Altria, McDonalds, etc…) are still firmly in favor by Wall Street.

After the recent tariffs announcement, note the weakest sectors of the market highlighted in the red box (consumer discretionary, technology, and energy). And at the same time, note, from a capitalization and orientation classification, the strongest area of the market highlighted by the green box (large cap value).

Combine these factors and the market is confirming a flight to safe havens until the uncertainty subsides. Remember: Markets love good news, they can handle bad news, but they abhor uncertainty.

Amazon.com is nested within the consumer discretionary sector, and the broad-line retailers industry. This sector and industry is cyclical in nature and Amazon is considered a growth stock at its core due to its business models (e-commerce and web services to name two of the major components of Amazon).

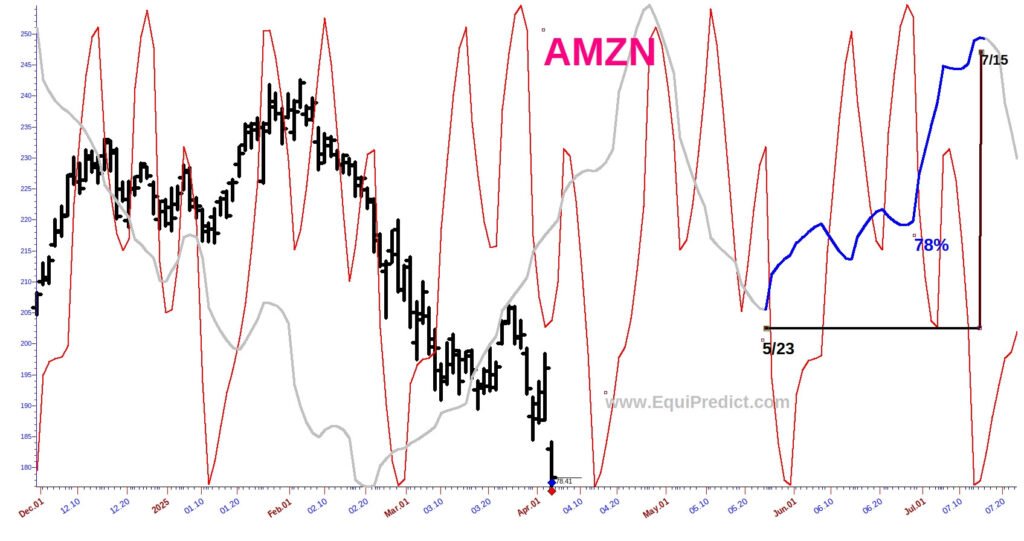

A consistent cycle has been present in Amazon’s stock price since January of 2023. The stock is approaching soon a cyclical low, but according to the forecast, for shorter-term traders, a more certain time to acquire shares appears to be at the tail end of May 2025.

The stock may soon find some bullish support inside April manifesting as sideways consolidation or even a snap-back rally, but a larger selloff may be in the works sometime after May 1st.