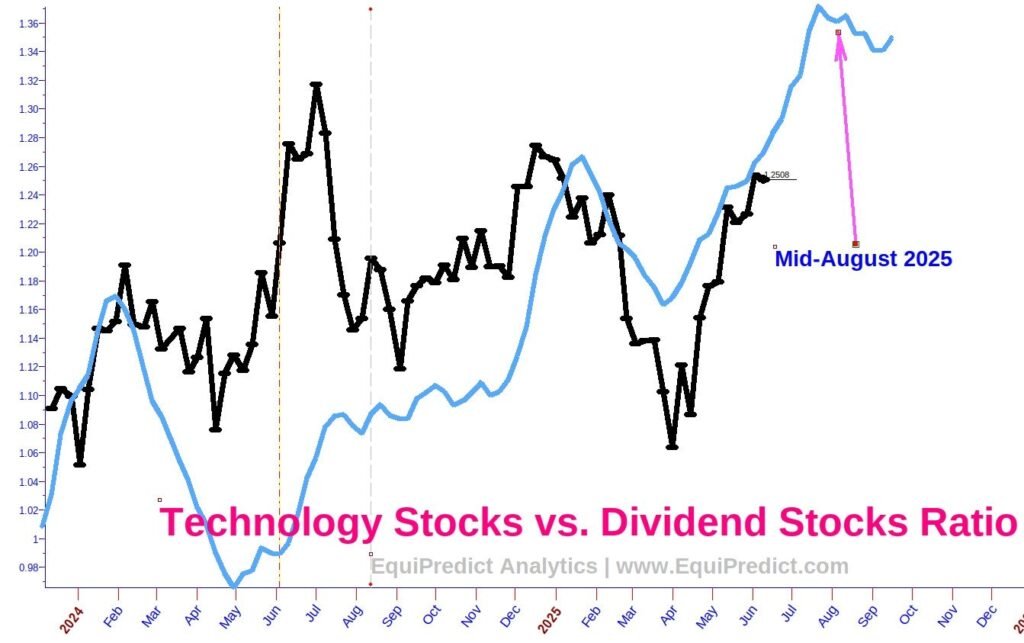

Wall Street’s risk appetite continues to be closely monitored. While market participants are showing signs of complacency, the forecast below suggests a continued “risk-on” environment through August 2025.

This outlook is especially relevant for investors deciding whether to stay with technology-oriented stocks or pivot toward dividend-paying value stocks.

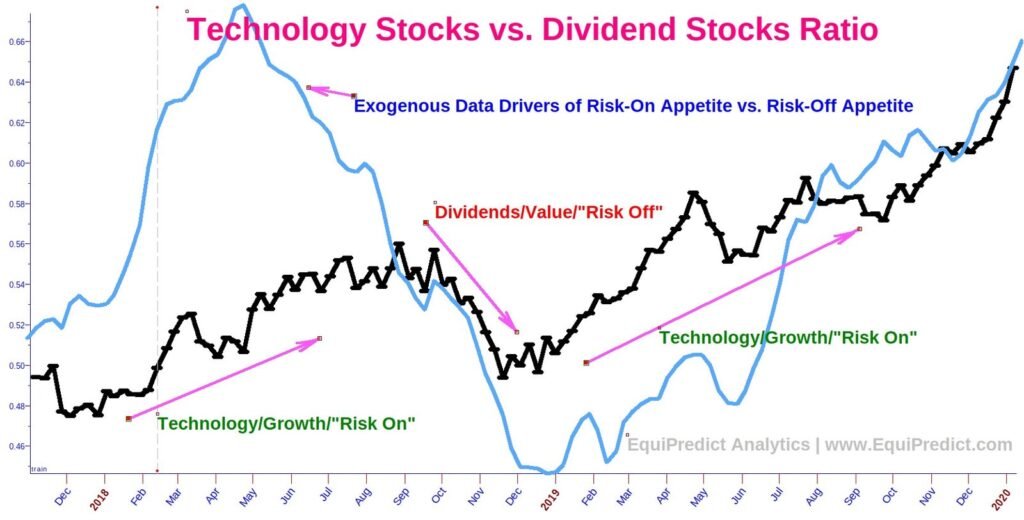

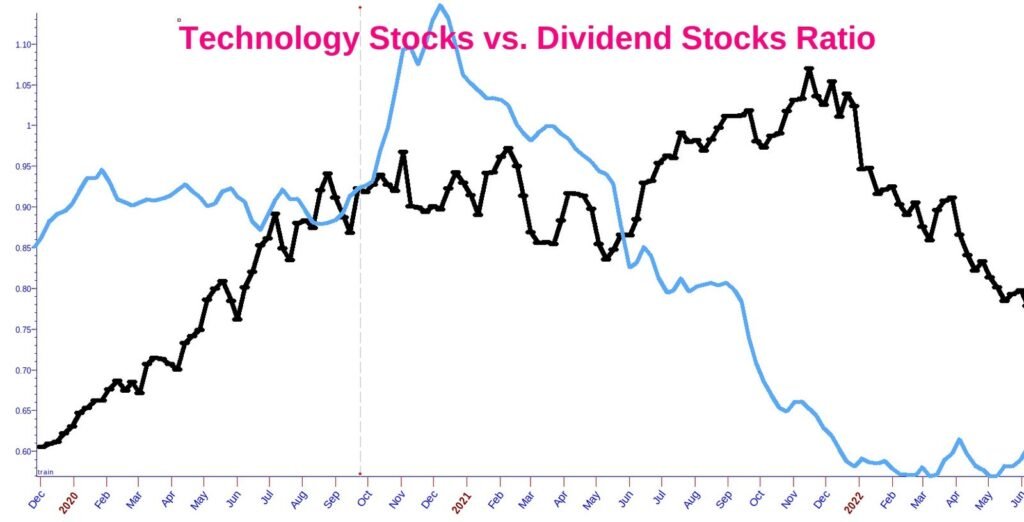

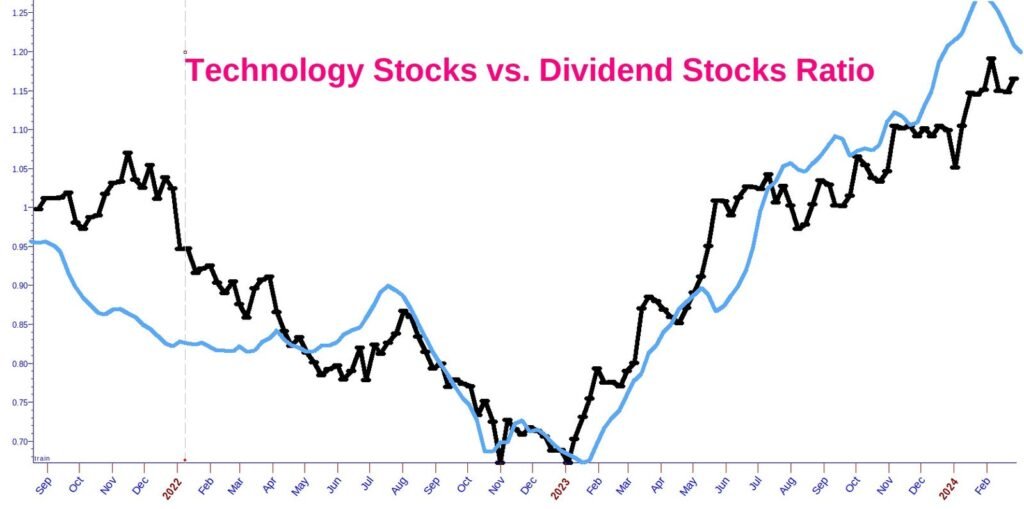

The charts below span from 2018 to the present. The black line represents a ratio of technology stock performance vs. dividend stock performance. When the black line rises, it indicates that Wall Street is favoring tech stocks — a risk-on signal. When the line declines, it signals a rotation into dividend-paying stocks — a risk-off environment.

The light blue line is a composite forecast built from exogenous drivers highly correlated with this ratio. These drivers help us anticipate future shifts in market sentiment.

Despite the “doom and gloom” sentiment echoed across mainstream financial media, this model points to continued bullish momentum into August 2025. Based on this data, dividend stocks are unlikely to gain favor until mid-to-late August.

As we approach August, a shift in Wall Street’s risk appetite appears increasingly likely. A deeper analysis of potential trend changes will be published in late July and early August